Compliance

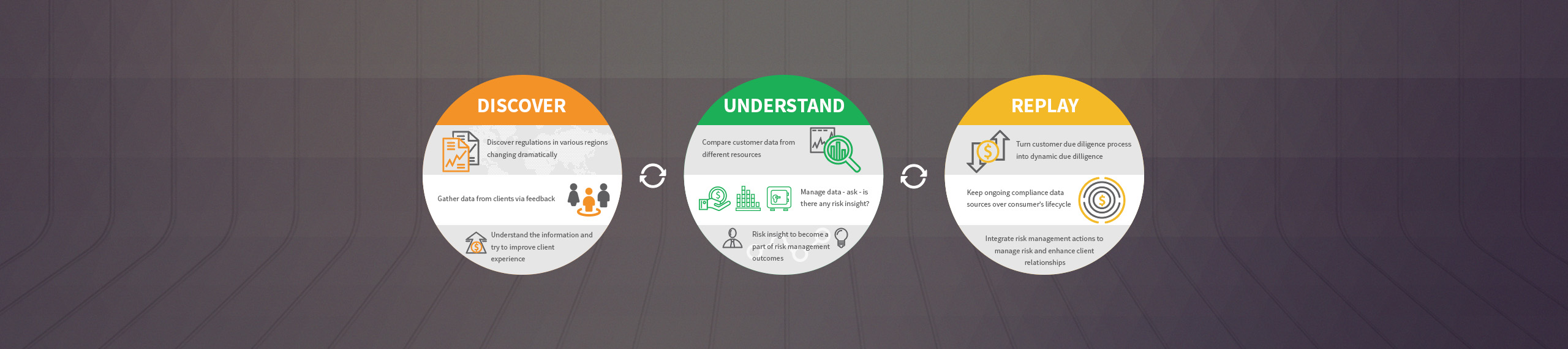

We have a proactive approach to compliance as we understand that there are thousands of regulations for financial activity around the world, which are constantly evolving. We have implemented robust compliance techniques to ensure that all requirements by regulators and financial partners are met. Through state-of-the-art compliance technology we effectively reduced the inherent risk factors and improved operational efficiency, as well we have lowered the cost of our AML compliance process.

Access to data in 40 countries for over 4 billion people from 145 data sources will aid us in providing superior service and enable the users to transfer funds instantly. Additionally, in today’s world, operational and compliance risk have become more complex and tangled, increasing potential for failed transactions, which cause customer confusions. Through our understanding of this, our innovative breakthrough KYC, identification and fraud prevention technology based resources, assist us with minimizing customer interaction, while mitigating the risk from online fraud.

- Proactive approach to compliance

- Breakthrough KYC identification technology process

- Access to customer data 4 billion

- Real-time KYC in 45 countries

- Access to 25+ global KYC watch list